2025-11-30 07:02:35 • Asset ManagementShareResizeFormer Jupiter fund managers Dermot Murphy (left) and Ben Whitmore established Brickwood Asset Management last year after leaving the FTSE 250 groupBrickwood Asset Management, the venture set up by former Jupiter star investor Ben Whitmore, recorded a profit of more than £450,000 during its first few months in business.Accounts filed with Companies House show the firm, which was founded by Whitmore last year with former Jupiter colleagues Claudia Ripley and Dermot Murphy, generated revenue of £1.5m during the financial year to the end of March.

Read More

2025-12-04 10:21:24 • Asset ManagementShareResize'There is a very large group doubling down on interest in this area' says the ESG bossThe chief executive of Impax Asset Management says the London-listed group is eyeing business wins in the US, as some of its larger rivals continue to retreat from sustainable investments following Donald Trump’s return to the White House.“A lot of asset owners are worried about their reputation and lawsuits around the topic,” Ian Simm toldFinancial News.“At the same time, there is a very large group doubling down on interest in this area. They see that if it’s correctly positioned, it is consistent with their fiduciary duty.”

Read More

2025-12-21 07:03:05 • Asset ManagementShareResizeThe EU’s highest-rated ESG funds bled €7.1bn between July and September — their eighth consecutive quarter of redemptionsPhoto: Getty ImagesAsset managers have stopped launching ‘dark green’ funds in Europe, as greenwashing fears prompt many to steer clear of products with the region’s highest sustainability rating.According to data from Morningstar, just four Article 9 funds were launched during the third quarter of 2025 — the lowest number rolled out over a three month period since the sustainable investment boom in 2021.

Read More

2025-12-03 06:09:50 • Asset ManagementShareResizeThe Dubai International Financial Centre has seen its number of asset and wealth managers grow to 440, an increase of more than 100 over the past two yearsPhoto: Bloomberg/Getty ImagesBlackRock, Amundi and Natixis Investment Managers have seen assets under management in the Middle East swell to record levels, as interest in the region continues to grow among fund groups.“We’re now at an all-time high for assets under management in the Middle East, across multiple affiliates,” Andrew Benton, head of northern Europe and Middle East and North Africa at Natixis Investment Managers, toldFinancial News.

Read More

2025-12-14 20:08:40 • Asset ManagementShareResizeLiontrust has struggled to stem significant outflows from its business for several yearsPhoto: Alamy Stock PhotoLiontrust Asset Management recorded outflows of more than £1bn from its funds in the three months to the end of September, extending a period of redemptions from the UK-listed fund group.In a trading update on 7 October, the firm said investors pulled a net £1.2bn from the business during the period, a slight increase on the £1.1bn redeemed during the same quarter in 2024.

Read More

2025-12-12 09:58:11 • Asset ManagementShareResizeLiontrust CEO John Ions said the return to net inflows ‘has taken longer than we expected'Photo: Alamy Stock PhotoLiontrust, the London-listed fund group, is targeting another £1.5m in cost savings after suffering a 39% drop in pre-tax profit.Half year results published on 20 November, which cover the six months to the end of September, show adjusted profit before tax of £15.7m, down from £25.8m over the same period in 2024.

Read More

2025-12-24 11:25:16 • Asset ManagementShareResizeStefan Hoops predicts the market for stablecoins ‘is going to get bigger’Photo: Bloomberg via Getty ImagesDWS chief executive Stefan Hoops predicts stablecoins could evolve to become a “gigantic market”, as the German asset manager seeks to capitalise on recent regulatory approval received by one of its joint ventures to launch the digital tokens.Last month AllUnity, a joint venture backed by DWS, Galaxy Digital and Flow Traders, launched EURAU — the first Euro stablecoin to win approval from German financial regulator Bafin.

Read More

2025-12-02 13:17:53 • Asset ManagementShareResizeDWS said it wants to seal partnerships so it can 'participate in tokenisation at scale'Photo: SOPA Images/LightRocket via Getty ImagesDWS, the listed asset manager majority-owned by Deutsche Bank, has kick-started talks with specialist service providers and distributors as it embarks on a major tokenisation push.The Frankfurt-headquartered group is preparing to tokenise its first fund, a move that would allow investor holdings to be held on a blockchain similar to the technology used to determine ownership of cryptocurrencies.

Read More

2025-12-05 15:07:02 • Asset ManagementShareResizeWhile passive investing has boomed over the past 25 years, recent market volatility and index concentration risk are among factors that have prompted investors to consider increasing their allocation to active strategiesPhoto: Alamy Stock PhotoRichard Oldfield is group chief executive of SchrodersWhere is the familiar scepticism toward active management? Weren’t active investment strategies, especially in liquid markets like the US, supposed to be facing extinction?

Read More

2025-12-18 17:47:08 • Asset ManagementShareResizeThe UK government has unveiled several measures to entice more investment in domestic companies as funds continue to lagPhoto: In Pictures/Getty ImagesAlmost £120bn has been yanked from UK-focused investment funds since the country voted to leave the EU nearly a decade ago.Data from Morningstar covering June 2016 to the end of August 2025 shows investors have pulled a total of £118bn from UK equity funds, with £21bn exiting this year alone.

Read More

2025-11-29 10:33:48 • Asset ManagementShareResizeLazard is headquartered in New YorkPhoto: Getty ImagesLazard Asset Management has appointed Christopher Hogbin as chief executive, succeeding Evan Russo, who will step down in December after more than three years in the top job.Hogbin joins from AllianceBernstein, where he is global head of investments and a member of the asset manager’s executive leadership team. He has worked at the firm for more than 20 years.

Read More

2025-12-07 17:00:06 • Asset ManagementShareResizeJupiter, which is headquartered in the Zig Zag building in London's Victoria, has seen its share price surge by more than 70% this yearPhoto: Alamy Stock PhotoJupiter, the FTSE 250-listed asset manager, has continued the positive momentum it recorded during the first half of the year by pulling in £300m of new money during its latest quarter.According to a trading update published on 15 October, Jupiter posted the majority of inflows across its retail, wholesale and investment trust business, capturing £800m during the three-month period.

Read More

2025-12-18 13:48:49 • Asset ManagementShareResizeThe new strategy will be managed by HSBC Asset Management’s Capital Solutions team, which was formed in 2022 to provide investors access to private credit strategiesPhoto: In Pictures via Getty ImagesHSBC Asset Management has partnered with its parent bank to launch a new trade finance strategy, tapping into growing institutional investor demand for exposure to private credit.The $808bn asset manager has rolled out its Trade and Working Capital Solutions strategy in partnership with HSBC’s Global Trade Solutions business.

Read More

2025-12-09 09:49:09 • Asset ManagementShareResizeAfter leaving Man Group at the end of 2016, Eliot worked at Insight Investment as a director and chief risk officer for five yearsPhoto: Bloomberg/Getty ImagesJonathan Eliot, a former chief risk officer at Man Group, has joined the board of Pimco’s European business.Eliot, who left the FTSE-listed alternatives group in December 2016 after almost six years in the role, has taken on an independent non-executive director role on the board of Pimco Europe, the UK-registered entity of the US bond giant.

Read More

2025-12-07 19:52:25 • Asset ManagementShareResizeM&G is working towards its end-of-year cost saving target of £230mPhoto: Alamy Stock PhotoM&G has cut more than £200m in costs as the UK-listed savings and investments group heads towards an upgraded target it set at the start of the year.Half-year results published on 3 September showed the FTSE 100 firm has shaved £213m in expenses since unveiling a transformation programme at the start of 2023.

Read More

2025-12-09 16:56:56 • Asset ManagementShareResizeNeil Woodford’s Equity Income fund was suspended in June 2019, trapping around 300,000 retail investorsPhoto: Alamy Stock PhotoThe Financial Conduct Authority has fined Neil Woodford £5.9m for failures relating to the collapse of his flagship Equity Income fund in 2019.The UK regulator has also fined Woodford Investment Management, the company he founded in 2014, £40m and banned the former star stock picker from holding senior manager roles and managing funds for retail investors.

Read More

2025-12-06 06:15:28 • Asset ManagementShareResizeMuch of the growth is predicted to come from market returns rather than from asset managers gathering sizeable inflowsPhoto: Alamy Stock PhotoThe amount of money overseen by the global asset management sector is set to rise to more than $130tn over the next two years, but fund groups are being urged to pivot to Asia and target retail investors for the best chances of winning new business.According to a report from Broadridge, global assets will rise to $132tn by 2027, up from around $114tn currently.

Read More

2025-12-05 21:36:26 • Asset ManagementShareResizeTwo long-term asset funds from Schroders Capital will be made available to certain Hargreaves Lansdown clientsPhoto: Peter DazeleyThis is an online version of FN’s asset management newsletter. Get it straight to your inbox each week hereAsset managers talk a lot about democratisation of private assets, a booming segment of the industry that doesn’t necessarily tick all the boxes for retail investors.

Read More

2025-11-30 23:17:07 • Asset ManagementShareResizeTerry Smith, one of Britain’s best-selling fund managers, has been a Mauritius resident since 2017Photo: Getty ImagesSpare a thought for veteran stock-picker Terry Smith, who has seen his pay drop for the third year in a row.Accounts filed with Companies House this week show the Fundsmith founder took home £23m last year, down from around £28m he was paid over the previous 12 months.

Read More

2025-12-10 19:42:58 • Asset ManagementShareResize'We need to innovate because this industry is not standing still,' Wunderlin tells FNIllustration: Danilo Agutoli for FNGeorg Wunderlin is in charge of one of the most profitable and fastest-growing businesses at Schroders, but he is modest when it comes to how much of that success is down to him.When Wunderlin joined Schroders in 2019 as global head of private assets, the FTSE 100 group oversaw roughly £44bn across its private assets and alternatives units.

Read More

2025-12-14 15:13:07 • Asset ManagementShareResizeMatthew Beesley has cut costs and diversified Jupiter since becoming CEO in 2022, but its future remains uncertainPhoto: Bloomberg/Getty ImagesJupiter had a year to forget in 2024, when the departure of star stock-picker Ben Whitmore sparked outflows of more than £10bn.The FTSE 250 group has been grappling with heavy outflows for years, with investors yanking around £33bn from its funds since 2018.

Read More

2025-11-25 20:48:01 • Asset ManagementShareResizeNew York-headquartered BlackRock saw some of the strongest inflows across its iShares ETF business in the three months to the end of SeptemberPhoto: Getty ImagesBlackRock’s assets under management reached a new high of $13.5tn at the end of September, with net inflows at the world’s largest fund group buoyed by its ETF and private markets businesses. Quarterly results published by the New York-headquartered firm on 14 October showed it pulled in $205bn of new money during the third quarter, driven in part by record inflows across its iShares ETF arm.

Read More

2025-11-26 07:58:13 • Asset ManagementShareResizeKate Burke, who took over the top job at the US-headquartered asset manager in July, says private credit has not been ‘fully vetted’ during various market cyclesThe chief executive of Allspring Global Investments says the US-headquartered firm is steering clear of private markets amid growing “noise” in the sector and concerns about looming risks in private credit.“We are an active, public markets asset manager. Our suite of products and investment strategies are all on the active, public side,” Kate Burke toldFinancial News.

Read More

2025-12-07 06:27:12 • Asset ManagementShareResizeAbu Dhabi has proved to be a popular destination for asset managers looking to bolster their footprint in the Middle EastPhoto: Bloomberg/Getty ImagesThis is an online version of Financial News’s weekly asset management newsletter. To sign up, click hereThe Middle East is proving to be a big draw for asset managers.

Read More

2025-12-10 14:00:22 • Asset ManagementShareResizeAfter pushback against ESG there has been a ‘resurgence’ in sustainable global equitiesPhoto: Getty ImagesLombard Odier Investment Managers, the $78bn fund group, has acquired Ownership Capital to bolster its sustainable investment business.Amsterdam-based Ownership Capital, which started as an in-house portfolio within Dutch pension fund PGGM, was spun out in 2013 to provide investment services to other pension funds, foundations and endowments.

Read More

2025-12-12 13:05:00 • Asset ManagementShareResizeUBS is one of the largest ETF providers in Europe. The region gathered record inflows during the first six months of 2025 Photo: LightRocket via Getty ImagesUBS Asset Management has appointed Amanda Rebello to head its ETF and index fund sales division, succeeding Clemens Reuter who is retiring after more than 15 years at the Swiss asset manager.Rebello joins from DWS, where she was most recently based in New York as head of sales for US onshore across Xtrackers, the asset manager’s ETF division.

Read More

2025-12-20 21:25:22 • Asset ManagementShareResizeSome asset managers, hedge funds and banks are paying significantly more than their peers for identical products and services offered by the same providersPhoto: Bloomberg/Getty ImagesRapid growth across private markets has sparked a sharp increase in the fees that some specialist data vendors are charging their financial services clients, with contract prices soaring by as much as 40%.According to a study by Substantive Research, data vendors are increasingly adopting a “take it or leave it” approach to contract negotiations.

Read More

2025-12-03 04:07:34 • Asset ManagementShareResizeJose Minaya, who joined Newton parent BNY last year as global head of investments and wealth, said most of the changes he’s made since taking the top job are ‘common sense’Photo: Bloomberg via Getty ImagesThis is an online version of FN’s asset management newsletter. Get it straight to your inbox each week hereThere has been plenty of change at Newton Investment Management since the start of the year, with the departures of chief executive Euan Munro and co-CIO Mitesh Sheth among the most significant.

Read More

2025-12-19 23:37:42 • Asset ManagementShareResizeM&G said it expected to begin to generate new business flows in the coming months through its partnership with Dai-ichi Life, the Japanese insurance group which it sold a 15% stake in the business to in MayPhoto: Bloomberg via Getty ImagesM&G’s assets under management rose £10bn during the third quarter, buoyed by inflows into its asset management business.The UK-listed group saw assets rise to £365bn at the end of September, up from £355bn at the end of June. It recorded net inflows of £1.8bn across its asset management and life divisions, bringing M&G’s total haul for the first nine months of the year to £3.9bn.

Read More

2025-12-08 07:04:52 • Asset ManagementShareResizeReform UK leader Nigel Farage, left, and deputy Richard Tice visited the Bank of England last month for a meeting with governor Andrew Bailey. That might be the first of many engagements with the finance sectorPhoto: Henry Nicholls/Getty ImagesTop firms in the City are beginning to take the prospect of a Reform UK government more seriously as Nigel Farage’s party romps ahead of its political rivals in the polls.Executives and senior leaders at banks, asset managers, wealth firms and financial regulators have stepped up their monitoring of the party in recent months as its right-wing populist message resonates with more of the British public.

Read More

2025-11-26 19:46:57 • Asset ManagementShareResizeSchroders has rolled out active ETFs focused on global equities and investment grade corporate bonds, marking its debut in a fiercely competitive areaPhoto: Peter DazeleySchroders has made its first foray into the European ETF market, joining a growing list of asset managers tapping the fast-growing sector.The FTSE 100 group has rolled out two active ETFs — one investing in global equities and another focused on investment grade corporate bonds — designed to “complement Schroders’ existing range of products”.

Read More

2025-12-11 01:57:33 • Asset ManagementShareResizeDespite recording net outflows at a group level, Schroders’ wealth and private markets businesses pulled in new money during the first half of the yearPhoto: Peter DazeleySchroders, the UK-listed asset manager, recorded net outflows of £1bn during the first half of the year, with transformation costs and other expenses denting its pre-tax profit.Half year results published by the London-headquartered group on 31 July show assets under management of £776.6bn remained broadly flat on the same period last year.

Read More

2025-12-18 06:07:59 • Asset ManagementShareResizeDavid Solomon, Goldman Sachs's chief executive, said Industry Ventures 'pioneered venture secondary investing and early-stage hybrid funds'Photo: Kent Nishimura/Getty ImagesGoldman Sachs has acquired venture capital firm Industry Ventures for nearly $1bn in a boost to its asset management unit.The Wall Street investment bank, which has been bolstering its wealth and asset management business in recent years, has acquired the San Francisco-based firm, which has around $7bn in assets under management, it said in a statement.

Read More

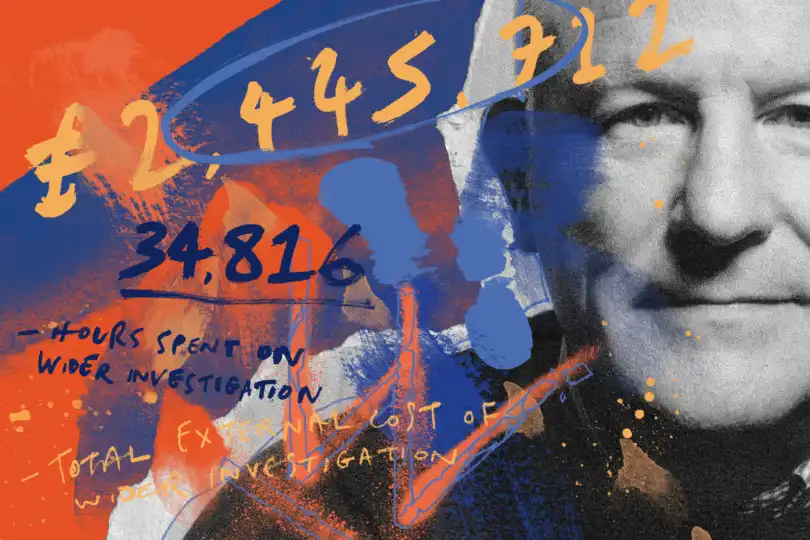

2025-11-30 06:28:15 • Asset ManagementShareResizeThe FCA has spent more than 34,800 hours on its investigation into the collapse of Neil Woodford’s flagship fund, data obtained by FN showsIllustration: illustration: Ben TallonThe Financial Conduct Authority has spent at least £2.4m on its long- running investigation into the collapse of Neil Woodford’s flagship fund, which this month culminated in a multimillion-pound fine for the former star stock-picker.Data obtained byFinancial Newsthrough a Freedom of Information Act request also revealed the City watchdog has devoted at least 34,816 hours to the case, which began in June 2019 when the Woodford Equity Income fund was suspended.

Read More

2025-12-24 11:04:23 • Asset ManagementShareResizeManagement fees for State Street's investment division also reached a new record as at the end of SeptemberPhoto: In Pictures/Getty ImagesState Street’s investment management arm saw assets grow to a new record during the third quarter, with its ETF business helping to draw in new client money.State Street Investment Management gathered net inflows of $26bn, according to a trading update published on 17 October.

Read More

2025-12-24 16:06:56 • Asset ManagementShareResizeSchroders Capital is bolstering its dedicates sales team as investor demand increases for private markets accessPhoto: Peter DazeleyFTSE 100-listed fund management group Schroders is on track to bolster its dedicated private markets team by the end of this year and expects headcount to continue growing.The £817bn asset manager outlined in March plans to build a specialist sales team across its private markets division, Schroders Capital. Its aim was to help “drive flows into our targeted growth capabilities”.

Read More

2025-12-05 21:09:08 • Asset ManagementShareResizeUK assets under management have recovered from a 2022 slump, which saw them plummet from a previous highPhoto: SOPA Images/LightRocket via Getty ImagesAssets overseen by UK fund groups have reached a peak of £10tn, with retail and overseas investors helping the sector recover from a market-driven drop in 2022.According to the Investment Association, assets overseen by the trade body’s members climbed 10% last year, increasing from £9.1tn at the end of 2023. The IA said strong equity returns and better economic conditions were among factors that helped buoy assets last year.

Read More

2025-12-07 20:18:18 • Asset ManagementShareResizeJohn Donohoe said a concerted push by governments to encourage investment into private markets was driving interest in the fast-growing sectorThe chief executive of Carne Group expects growth across private markets will be driven by wealth clients in Europe, similar to how hedge funds experienced a growth spurt after they were adopted by a wider group of investors. John Donohoe, who founded Europe’s largest third-party management company in 2004 after more than a decade at Deutsche Bank, has predicted that private markets products — such as long term asset funds in the UK — will follow the same adoption rate as hedge funds.

Read More

2025-12-20 11:12:38 • Asset ManagementShareResizeColumbia Threadneedle, which is headquartered on Cannon Street in London, considers ETFs as a new growth area for its businessPhoto: Alamy Stock PhotoColumbia Threadneedle says it wants to win market share from some of its larger rivals in Europe, as the $690bn asset manager gears up to make its debut in the continent’s fast-growing ETF market.The London-based firm, which is owned by US-headquartered Ameriprise Financial, plans to roll out four active ETFs later this year. It will join a host of other asset managers that have launched active ETFs in 2025, including Jupiter and HSBC.

Read More

2025-12-04 08:21:03 • Asset ManagementShareResizeChristel Rendu de Lint joined Vontobel in 2021 after almost 15 years with Union Bancaire PrivéeIllustration: Danilo Agutoli for FNHaving more than one CEO rarely works out in the asset management sector.Standard Life Aberdeen abandoned the approach in 2019, almost two years after Martin Gilbert and Keith Skeoch became joint leaders when Standard Life and Aberdeen Asset Management merged.

Read More

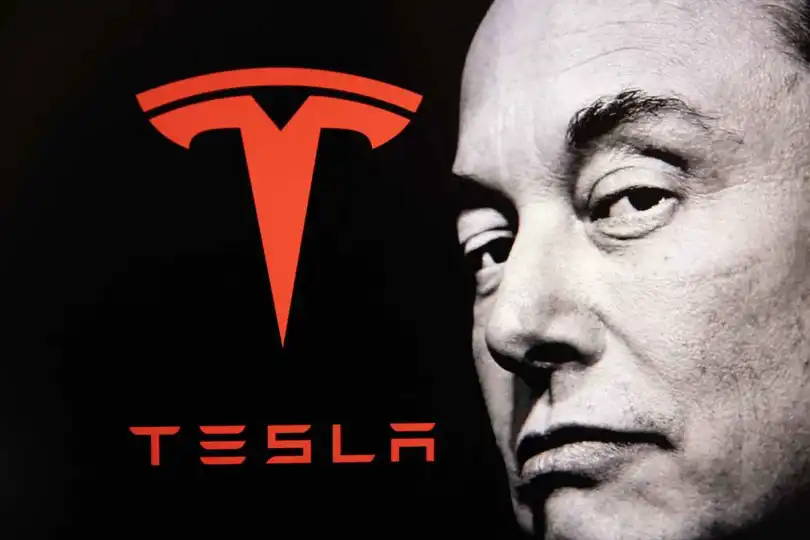

2025-12-05 21:33:21 • Asset ManagementShareResizeAre CEOs like Musk holding too much sway over shareholders?Photo: Sebastian Willnow/dpa/AlamyCorporate governance experts and City investors have warned Elon Musk’s record-breaking $1tn pay deal could set a “dangerous precedent” that would pave the way for other companies to give their senior executives outsized packages.More than 75% of the votes cast at Tesla’s shareholder meeting in Texas on 6 November were in favour of giving the Tesla chief executive the payout, which would also eventually see his shareholding in Tesla increase to around 25%.

Read More

2025-12-04 06:17:19 • Asset ManagementShareResizeImpax, which is headquartered close to London’s Leicester Square, has seen its share price drop more than 20% this yearPhoto: Alamy Stock PhotoImpax Asset Management, the UK-listed sustainability asset manager, posted outflows of £1.4bn during the last quarter, bringing the total amount investors have pulled from the group to £13bn over its full financial year.In a trading update published on 8 October, the AIM-listed firm said the majority of the outflows in the last quarter came from its listed equities products, adding to the substantial redemptions that the firm has encountered this year.

Read More

2025-12-06 18:13:32 • Asset ManagementShareResizeElon Musk will be eligible for a pay award worth around $1tn if he meets a demanding set of targets, including raising Tesla's market value and delivering more electric vehiclesPhoto: Hans Lucas/AFP via Getty ImagesRoyal London Asset Management, Legal & General and Aberdeen voted against a $1tn pay package for Tesla boss Elon Musk, joining a cohort of City fund groups that opposed the bumper remuneration deal.RLAM and Aberdeen said they engaged with Tesla ahead of its annual general meeting on 6 November, but voted against plans to award Musk with more than 400 million additional Tesla shares if he meets certain targets.

Read More

2025-12-10 07:22:40 • Asset ManagementShareResizeColumbia Threadneedle’s plan to nip at the heels of its rivals hinges on it launching active ETFs later this yearPhoto: Alamy Stock PhotoThis is an online version of FN’s asset management newsletter. Get it straight to your inbox each week hereIt’s been almost four years since Columbia Threadneedle acquired BMO’s European asset management business, a deal which added a sizeable chunk of assets and brought a range of new investment capabilities to the Ameriprise-owned firm.

Read More

2025-12-04 15:27:55 • Asset ManagementShareResizeVTB filed a lawsuit against JPMorgan last year claiming damages as a result of sanctions imposed on Russian businesses following the country's invasion of UkrainePhoto: Bloomberg/Getty ImagesA Russian court has upheld an appeal in favour of state-owned VTB Bank, allowing it to obtain more than $400m from several JPMorgan entities, including one of its investment trusts with assets in the country.The board of the JPMorgan Europe, Middle East and Africa Securities trust said in a stock market statement published on 11 September that a court had upheld a previous judgment awarding damages of $439m to VTB Bank.

Read More

2025-12-09 12:29:07 • Asset ManagementShareResizeSchroders was among the first financial services groups in the City to unveil flexible working for staff following the Covid pandemicPhoto: Bloomberg via Getty ImagesChief executives of Aberdeen and Schroders, two of the UK’s largest asset managers, have toldFinancial Newsthey have no plans to overhaul their hybrid working policies, despite some financial services firms in the City asking staff to spend more time in the office.“We had a three-day-a- week policy well before I joined,” Jason Windsor, CEO of Aberdeen toldFN.

Read More

2025-12-23 12:35:06 • Asset ManagementShareResizeVanguard said its funds’ adopted a ‘case-by-case analysis of each proposal’Photo: Bloomberg via Getty ImagesVanguard, the world’s second largest asset manager, did not back any environmental or social shareholder proposals in the US during the recent proxy voting season — the second year in a row it has opted not to do so.The Pennsylvania-headquartered asset manager, which oversees more than $10tn, assessed 261 proposals from shareholders on environmental and social issues ahead of annual shareholder meetings this year. This was down from 400 during the previous year.

Read More

2025-12-21 13:38:02 • Asset ManagementShareResizeDimensional plans to list two active ETFs in London and Frankfurt by the end of 2025Photo: Alamy Stock PhotoOne of Dimensional’s most senior executives claims the US asset manager has not missed the ETF boom in Europe, as it looks to replicate the success it has had in its home market.“We don’t think we’re late in any way, shape or form,” Nathan Lacaze, co-chief executive of the UK arm of Dimensional Fund Advisors toldFinancial News.

Read More